Investor Additionality

In short

As a private equity investor offering operational support to portfolio companies, Vidia is not just interested in acquiring and commercially developing climate solution companies. With our portfolio management activities, we help to improve the impact productivity of assets, creating additional financial value in lockstep with climate impact. But how exactly do we support our portfolio companies to generate positive climate impact at a faster pace and a greater scale than before? Using a general definition of investor impact, below we take a closer look at four different measures.

Investor Impact

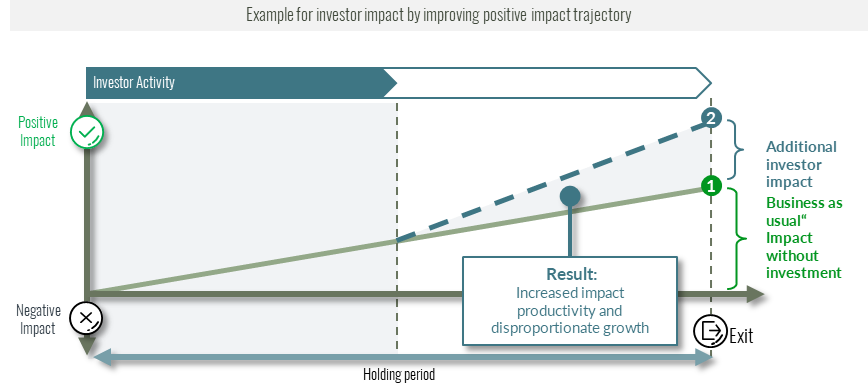

In general, we understand investor impact as a causal contribution to the improved impact of an invested asset. For instance, through capital provision, engagement, control or non-financial operational/strategic support, the positive impact productivity of an asset (i.e. its impact trajectory) can be further improved compared to an “impact as usual” case (see figure 1 below). This results in the generation of additional impact at the asset level. Note that the term “investor impact” can also be used to describe the transformation of the negative impact productivity of an impact asset, so that the impact generated through its business activities becomes significantly less negative, neutral (“sustainable”) or even positive over time. In case of a “Brown-to-Green” transition strategy, investors transform an asset with an outsized carbon footprint into a significantly less unsustainable version by virtue of a reduced carbon footprint.

Figure 1: Example for investor impact

Vidia’s Investor Impact

Being an effective majority owner that positively influences the climate impact performance of a portfolio company, is a key area of interest for Vidia. In contrast to a “Brown-to-Green” transition strategy, we build on the climate impact performance at the time of investment in a climate solution company, while anticipating performance growth during the holding period in line with the Vidia business case. Next to generating greater climate impact, we enable our assets to become more competitive. Hence, a more fitting term to describe our approach to investor impact would be a “Green-to-Green” value creation strategy.

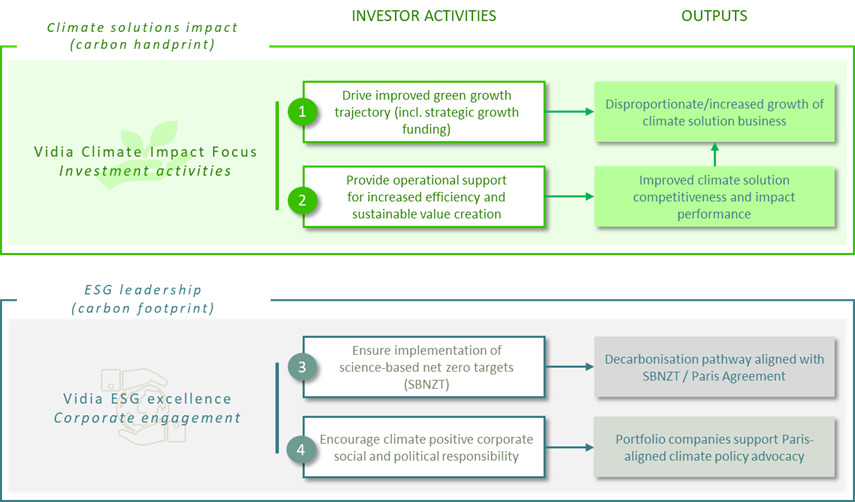

We intent to generate investor impact through four main activities as shown in figure 2 below. The first two activities include strategic priorities that are a direct result of our focus on climate impact. The climate solution business of a company plays an important strategic role for sustainable value creation. Accordingly, we take advantage of a relatively high degree of “lockstep”/”co-linearity”: the improvement of the climate impact largely goes hand in hand with an improvement of a company’s financial performance.

- Where economically feasible, we enhance the growth trajectory of the climate solution business, be it organically or through buy & build strategies.

- Moreover, we create value by providing non-financial, operational support that enhances the efficiency, competitiveness, and value creation capabilities of the whole company.

The other two activities are driven by our commitment to ESG excellence:

- On the one hand, we intend to firmly engage with each portfolio company to commit to science-based net-zero targets beyond our investment.

- On the other hand, we recognize the systemic impact potential of an accelerated system-wide transition to a net zero economy. Therefore, we promote awareness building and advocacy for Paris-aligned climate policies as an integral part of corporate social responsibility (CSR) and corporate political responsibility (CPR) activities.

Figure 2: Climate solutions impact and ESG leadership

During the holding period, our impact measurement and management activities include periodic qualitative assessments, e.g. through interviews with/surveys of the management of a portfolio company with regard to the quality of our investor impact and any overachievements within the initially agreed business plan.

Beyond our core investment and support activities, we intend to generate positive impact through supplementary activities at the management level, e.g.:

- supporting relevant standards such as the operating principles for impact management (“Impact Principles”) promoted by the Global Impact Investing Network (GIIN)

- helping to grow and educate the market, sharing learnings and best practices related to climate impact investing and active membership in peer learning communities and networks

- decarbonizing our own operational emissions and pursuing voluntary offsetting and corporate climate engagement efforts

- actively advocating Paris-aligned industrial climate policies

So what?

Furthering investor impact can be a key driver of value creation as long as the degree of lockstep/co-llinearity is reasonably high

Vidia appreciates that the reality of portfolio company management sees a far from perfect degree of lockstep/co-llinearity. There is plenty of room for individual business judgements and the willingness to pay for sustainable performance improvements. However, furthering investor impact can be a key driver of value creation as long as the degree of lockstep/co-llinearity is reasonably high – and we believe that our asset selection strategy ensures that this is the case. In contrast to passively aligning capital allocations with positive impact assets (“impact-aligned investing”), we pursue positive investor impact by means of operational involvement and continuous improvement initiatives (“impact-generating investing”). Combined with a transparent and objective impact measurement and management system, this is Vidia’s definition of good impact investing practice.